in mature companies active in B2B with strong growth or in sectors with redeployment potential in the context of business transfers and management buy-outs (MBOs).

the growth of scale-ups through direct capital, as well as through the contribution of skills and networks

as a professional shareholder in our participations at the level of governance, strategy, development and financing.

financial interests with those of management.

Acquisition at a reasonable price

Partial financing of acquisitions by bank debt

Growth objective through commercial and technological dynamics

"Buy & Build" platform strategy

Exit policy in agreement with management

Investments in scale-ups are also made provided that the valuation is reasonable and that we can act as an active shareholder.

Mature companies are bought at (significantly) lower multiples, while being (often) less risky and being potentially fundable by bank debt. Our objective is to (re)move them towards growth.

No Data Found

No Data Found

No Data Found

As a percentage of the Group’s Net Assets Value, representing €52.1 million (latest estimate at 31/12/23, taking into account the capital increase in kind on 28/02/2024).

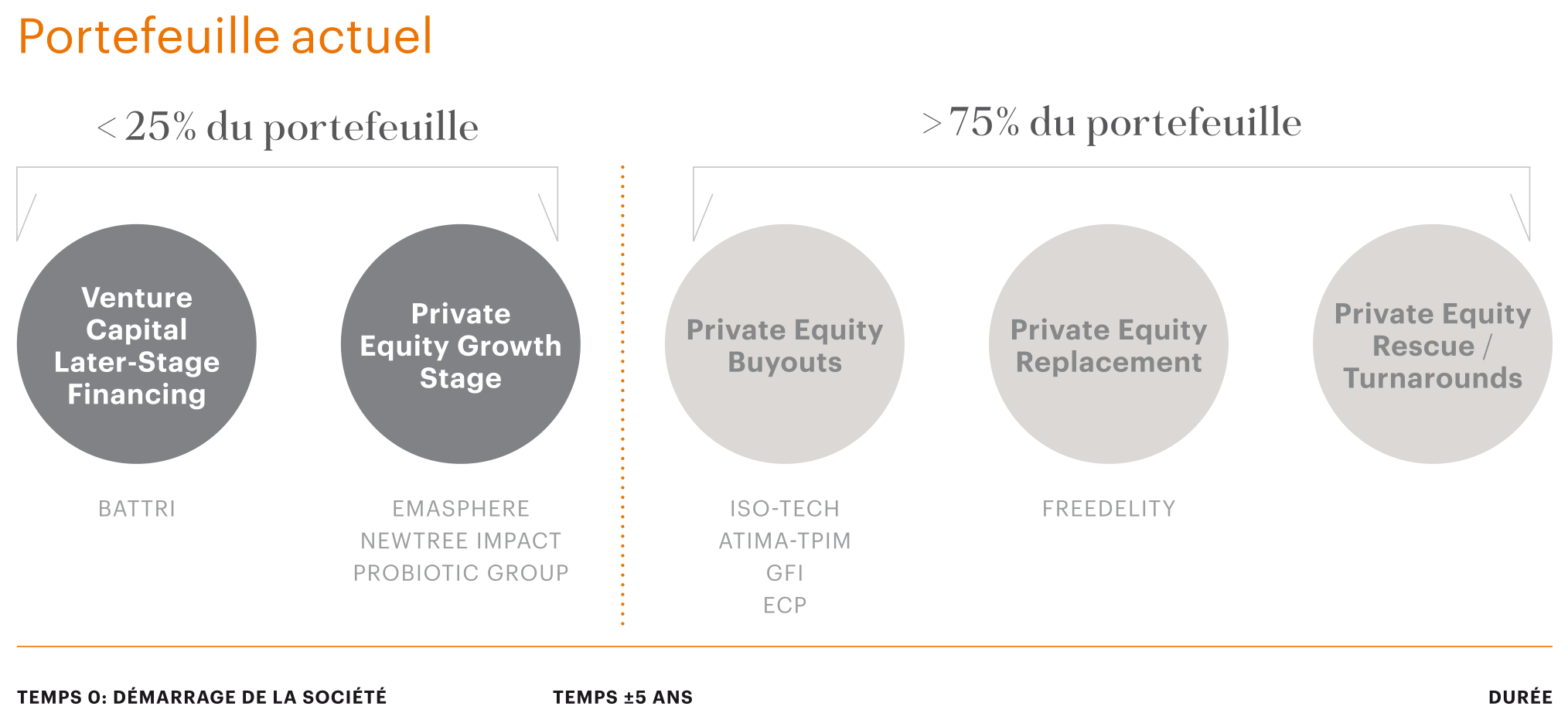

Whitestone Group invests mainly in SMEs based in Belgium in order to develop them through minority and majority shareholdings with a long-term impact (of the “Evergreen” type), while ensuring that the portfolio rotates. This is done mainly in profitable Belgian SMEs, with a progressive focus on the ESG dimension.

The portfolio is diversified in private companies, mainly (re)organised around the 3 new pillars:

Whitestone manages a SICAV-SIF, dedicated to experienced investors, which includes two sub-funds:

Next to its own funds, ECP offers personalised wealth management services by creating a financial plan tailored to your needs. Our teams of specialists in asset management, private equity, credit and real estate work to ensure that your wealth reaches the goals you have set for yourself and your family.

Discover European Capital Partners.

Route de Genval, 32

B-1380 Lasne

T +32 2 880 40 83

info@whitestone.eu

company no. / TVA :

BE 0467.731.030

©Copyright 2021 | All rights reserved

Site developed by Valorys

contact@valorys-conseil.com